Energy Planning and Budgeting Are Becoming Increasingly Weather-Dependent

In February 2021, Texas suffered a major power crisis. Severe winter storms brought some of the coldest weather the state had experienced since 1989. Consumers turned up their heating systems, increasing energy demand. Meanwhile, the cold weather froze natural gas wells and pipes. Freezing rain followed by extreme cold froze the mechanics of wind turbines and snowfall covered solar farm panels. The loss of generation plants, wind generation and solar energy, in addition to frozen gas pipes, nearly led to a total shutdown of the Electric Reliability Council of Texas (ERCOT) grid. More than 4.5 million homes and businesses were left without power. The market price for energy spiked from the typical $50/MWh up to $9,000/MWh during the storm.[1]

Extreme weather is increasingly affecting energy pricing

The 2021 Texas power crisis is just one example of how U.S. energy pricing is becoming increasingly sensitive to weather events and climate change. Changes in temperature, precipitation, and the frequency and severity of extreme weather events can affect energy supply and demand.

A warmer climate corresponds with rising air and water temperatures. These changes may reduce the efficiency of power production for fossil fuel and nuclear power plants, which use water for cooling.2 If the average climate warms by an average of 1.8°F, U.S. energy demand for heating is expected to trend downward, but energy demand for cooling could increase by about 5-20%, and warming will increase summer peak energy demand in most regions.

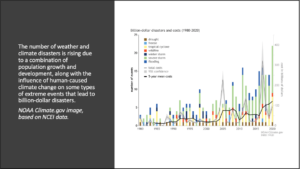

Meanwhile, extreme weather events also impact supply and demand, leading to fluctuations in energy prices, as seen with the winter storms of 2021. The frequency of extreme weather events has risen over the past 20 years, driven by rising global temperatures and other climatic changes. Heat waves and large storms are expected to become more frequent and more intense. In 2021, there were 22 separate billion-dollar weather and climate disasters across the U.S.; the previous annual record was 16 events, in 2017 and 2011.[2]

“Summers are becoming hotter and hotter, and now we’re naming hurricanes after letters and numbers,” said Dave Ryan, Constellation’s Chief Meteorologist. “They are getting more and more extreme, and consequently, organizations need the ability to be nimble in times of crisis.”

Limiting fiscal exposure by managing weather risks

Energy prices don’t have to be at the mercy of extreme weather events. There are opportunities for energy managers to be better informed and take action to reduce risks in their energy purchasing.

While Constellation actively communicated with customers when the winter storms struck this year, the sales team is also equally proactive in regularly discussing energy strategy with customers. In addition, staff meteorologists and market analysts regularly share insights during the monthly Energy Market Intel Webinars so customers can better understand the dynamics in the market and plan their energy purchasing.

Beyond information sharing, Constellation has developed an ecosystem of tools and plans to help organizations manage their power purchasing strategy. One of the no-cost resources is the MarketWatch® service, which allows customers to proactively monitor energy prices and make informed purchase decisions when their “strike” prices are close. This service can either send an email notification or purchase on our customers’ behalf when market prices reach the strike price. Another resource available to Constellation’s customers is the Information-to-implementation (i2i) reporting service, which helps customers plan their budget and make informed power-purchasing decisions.

Meanwhile, customers who want to reduce exposure to electricity price volatility may consider Constellation’s structured, systemic Minimize Volatile Pricing (MVPe) plan. With this plan, organizations can lock in higher percentages of load when prices are lower in comparison to historical prices as opposed to basic dollar-cost averaging approaches. Active participation may result in a reduced peak load contribution (PLC) and a lower monthly capacity charge the following year.

“The risk of market volatility is always there, especially during extreme weather events,” says Dave Pfeifer, Vice President and General Manager of the West. “But you can plan your purchases so that you are not buying energy in the eye of the storm when energy demand and prices are highest. There are opportunities to balance the peaks and manage your risk due to climate and weather.”

To stay informed on the latest energy purchasing trends, subscribe monthly Energy Market Intel Webinar now!

To learn more about specialized energy for your business, visit your association’s site.

[1] Guardian News and Media. (2021, February 20). Why the cold weather caused huge Texas blackouts – a visual explainer. The Guardian. https://www.theguardian.com/us-news/2021/feb/20/texas-power-grid-explainer-winter-weather.

[2] 2020 U.S. billion-dollar weather and climate disasters in historical context: NOAA Climate.gov. 2020 U.S. billion-dollar weather and climate disasters in historical context | NOAA Climate.gov. (2021, January 8). https://www.climate.gov/news-features/blogs/beyond-data/2020-us-billion-dollar-weather-and-climate-disasters-historical.