During the July Constellation monthly Energy Market Intelligence Webinar, Constellation’s Commodities Management Group (CMG) provided comprehensive coverage of various significant factors affecting the...

The post Webinar Analysts: How the Summer of 2024 is Shaping the Energy Landscape appeared first on Constellation's Energy4Business Blog.

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/dc/elements/1.1/] => Array ( [creator] => Array ( [0] => Array ( [data] => Constellation [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/rss/1.0/modules/content/] => Array ( [encoded] => Array ( [0] => Array ( [data] => 4 min readDuring the July Constellation monthly Energy Market Intelligence Webinar, Constellation’s Commodities Management Group (CMG) provided comprehensive coverage of various significant factors affecting the energy landscape. These included insights into the summer hurricane season, natural gas consumption for cooling demand, and capacity markets.

Weather Report

During the webinar, the team discussed how the summer of 2024 was on track to be the hottest on record, with above-normal temperatures across most of the U.S. This has led to strong power demand from air conditioning, which is expected to continue throughout the remainder of the high-temperature months, especially in the East and South. Additionally, the forecasted extreme heat is expected to lead to a market-anticipated shift in the gas balance.

The tropical storm outlook was covered, and the experts expect the season to be very active due to warm water temperatures and favorable atmospheric conditions. The webinar covered the varying impacts hurricanes can have on the energy industry, depending on the path, intensity and duration of the storm, as well as the effects on infrastructure, personnel and the power grid. Hurricane Beryl was used as an example to illustrate how a storm can disrupt LNG production and demand in the Gulf Coast.

All Things Economic

The energy transition and economic factors that drive the shift towards non-carbon resources were also topics of discussion. The challenges and opportunities associated with replacing reliable generation sources with more variable alternatives, such as wind, solar and batteries, were highlighted. Additionally, the webinar covered the role of metals and minerals in the energy transition and how they affect the cost and supply of energy. Interest rate projections and potential Fed rate cuts to support the economy were also explored.

Natural Gas Fundamentals

Constellation’s energy market experts analyzed the factors influencing natural gas prices and balances for the summer of 2024. They highlighted that prices peaked in June due to tight gas balances but later declined as a result of increased production, reduced LNG exports and the impacts from Hurricane Beryl. In terms of natural gas storage, levels were reported to be above the five-year average and the previous year’s levels, indicating a sufficient supply. However, storage surplus levels are expected to decline as the summer progresses. The team forecasts that storage will end the injection season at around 3,900 Bcf, which is considered adequate to meet the upcoming winter demands.

Power Burns

The discussion on the natural gas market during the summer highlighted the impact of power burns, or natural gas used for power generation, due to heat, with an average of 47 Bcf per day in the week ending July 10. This figure not only surpassed the previous week’s numbers but also the rates from the same period last year. Expectations are set for these power burns to remain strong throughout the summer, supported by the weather outlook that predicts continued hot conditions and high demand for air conditioning. Projections estimate that power burns could average around 47 to 48 Bcf per day in July and August, potentially exceeding levels seen in previous summers.

Capacity Markets

The discussion then moved to capacity markets in PJM and New England, designed to ensure the long-term power system reliability by procuring sufficient resources to meet peak demand. PJM and New England have different capacity market designs, including variations in the forward periods, auction schedules, resource accreditation and pricing rules.

For the PJM capacity market, updates were provided on the current base residual auction for the 2025-2026 delivery year. This auction is notable because it is the first to implement the effective load carrying capability (ELCC) method, which values resources based on their availability and performance during peak periods. Challenges facing the PJM capacity market were also addressed, including FERC’s rejection of the offer cap and capacity performance reforms, the court’s reversal of the DPL South price reduction, and the potential for volatility and uncertainty in auction results.

Regarding New England’s capacity market, the team discussed significant changes planned for the 2028-2029 delivery year. These changes include transitioning from a three-year forward and annual auction to a seasonal and prompt year auction, as well as revising the resource accreditation process based on fuel security and deliverability. The goal is to improve efficiency, reliability, transparency and cost savings for customers. However, potential implications for market participants were noted, such as uncertainty regarding future capacity prices, the risk of stranded assets, and the need for more flexible and responsive resources.

Market Trends and Temperature

The team concluded the webinar by looking at forward power charts, the “Market Temperature,” and other factors affecting the energy market.

We invite you to join us for our next Energy Market Intel Webinar on Wednesday, September 11 at 2 pm ET. Constellation energy experts will offer detailed and timely updates on factors affecting energy landscape such as weather, natural gas storage and production, and domestic and global economic conditions. Register by visiting www.constellation.com/marketintelwebinar.

© 2024 Constellation. The offerings described herein, if applicable, are those of either Constellation NewEnergy, Inc. or Constellation NewEnergy-Gas Division, LLC, affiliates of each other. Brand names and product names are trademarks or service marks of their respective holders. All rights reserved. The views, thoughts and opinions expressed in the webcast by each participant belong solely to the speaker and not necessarily to the speaker’s employer (including Constellation Energy Corporation or any of its affiliates), organization, committee or other group or individual. Constellation does not make and expressly disclaims, any express or implied guaranty, representation or warranty regarding any opinions or statements set forth herein or in the webcast. Constellation shall not be responsible for any reliance upon any information, opinions, or statements contained in the webcast or for any omission or error of fact.

The post Webinar Analysts: How the Summer of 2024 is Shaping the Energy Landscape appeared first on Constellation's Energy4Business Blog.

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://search.yahoo.com/mrss/] => Array ( [content] => Array ( [0] => Array ( [data] => [attribs] => Array ( [] => Array ( [url] => https://blogs.constellation.com/wp-content/uploads/2020/10/GettyImages-951643422_ret_recolorRainbow-2-scaled.jpg [type] => image/jpeg [medium] => image [width] => 2560 [height] => 1438 ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => [child] => Array ( [http://search.yahoo.com/mrss/] => Array ( [title] => Array ( [0] => Array ( [data] => Aerial view of the expressway, motorway and highway in circle [attribs] => Array ( [] => Array ( [type] => plain ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [thumbnail] => Array ( [0] => Array ( [data] => [attribs] => Array ( [] => Array ( [url] => https://blogs.constellation.com/wp-content/uploads/2020/10/GettyImages-951643422_ret_recolorRainbow-2-1024x575.jpg [width] => 640 [height] => 359 ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [copyright] => Array ( [0] => Array ( [data] => Julie Haviland [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) ) ) ) ) ) ) [1] => Array ( [data] => [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => [child] => Array ( [] => Array ( [title] => Array ( [0] => Array ( [data] => Efficiency Upgrades: Implementing Energy Savings Projects [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [link] => Array ( [0] => Array ( [data] => https://blogs.constellation.com/roadmap-to-sustainability/efficiency-upgrades-implementing-energy-savings-projects/ [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [pubDate] => Array ( [0] => Array ( [data] => Mon, 08 Jul 2024 14:25:32 +0000 [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [category] => Array ( [0] => Array ( [data] => Roadmap to Sustainability [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [1] => Array ( [data] => Sustainability & Energy Efficiency [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [2] => Array ( [data] => Energy Efficiency [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [3] => Array ( [data] => LED lighting [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [4] => Array ( [data] => sustainability goals [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [5] => Array ( [data] => greenhouse gas emissions [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [6] => Array ( [data] => HVAC upgrades [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [7] => Array ( [data] => EME [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [8] => Array ( [data] => utility expense management [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [9] => Array ( [data] => energy usage [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [10] => Array ( [data] => deep energy retrofit [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [11] => Array ( [data] => energy consumption [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [12] => Array ( [data] => GHG baseline [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [13] => Array ( [data] => infrastructure improvements [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [14] => Array ( [data] => capital budgets [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [15] => Array ( [data] => operations timelines [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [16] => Array ( [data] => ROI [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [17] => Array ( [data] => rebate programs [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [18] => Array ( [data] => incentive programs [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [19] => Array ( [data] => performance contracting [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [20] => Array ( [data] => design/build programs [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [21] => Array ( [data] => on-bill funding programs [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [22] => Array ( [data] => alternative financing [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [23] => Array ( [data] => monitoring and reporting [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [guid] => Array ( [0] => Array ( [data] => https://blogs.constellation.com/energy-management/a-business-guide-to-procuring-offsite-renewable-energy-copy/ [attribs] => Array ( [] => Array ( [isPermaLink] => false ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [description] => Array ( [0] => Array ( [data] =>Now that your organization has successfully set a greenhouse gas (GHG) baseline and begun to analyze an accurate view of your facilities’...

The post Efficiency Upgrades: Implementing Energy Savings Projects appeared first on Constellation's Energy4Business Blog.

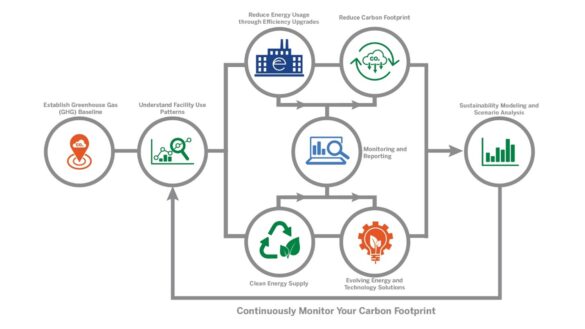

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/dc/elements/1.1/] => Array ( [creator] => Array ( [0] => Array ( [data] => Constellation [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/rss/1.0/modules/content/] => Array ( [encoded] => Array ( [0] => Array ( [data] => 3 min readNow that your organization has successfully set a greenhouse gas (GHG) baseline and begun to analyze an accurate view of your facilities’ energy usage and patterns using utility bill management platforms, it is time to consider what energy efficiency opportunities your organization can take to advance your sustainability goals. The U.S. Department of Energy (DOE) identifies energy efficiency as one of the easiest and most cost-effective ways to combat the climate crisis, reduce consumer energy costs, and improve U.S. businesses’ competitiveness.1

Energy efficiency projects are accessible, affordable and can directly lower GHG emissions through the reduction in utility consumption and associated utility expense. These upgrades can come in the form of simple infrastructure improvements, such as LED lighting and HVAC upgrades, or can take a more holistic, integrated approach in the form of a deep energy retrofit. If your organization is considering ways to reduce energy consumption here are some tips to start defining and prioritizing your facility improvements.

Start With a List

Before any upgrades can be considered, engage with key decision makers across your organization to draft an energy efficiency project list that includes potential upgrades that have become apparent after reviewing energy usage data. This list is instrumental when reviewing capital budgets, operations timelines, and requirements of systems in need of replacement. Creating the list should help identify what initiatives need to be prioritized so that you can create an actionable plan for implementation. The list also helps demonstrate the return on investment (ROI) of energy efficiency projects through long-term cost reduction and the life cycle assessment of current infrastructure, plus, it helps identify any available rebate or incentive programs.

Consider Funding Options Specific to Energy Efficiency Projects

Funding is still one of the most critical aspects of energy efficiency projects and not every company can finance a project upfront. Nearly 80% of energy buyers, when asked as part of the Smart Energy Decisions Sustainability Survey, mentioned budget concerns, with more than 30% of respondents saying they required a mechanism to finance their projects.2

There are several funding options that your organization can consider to make your energy efficiency projects become a reality.

- Performance Contracting: Working with your Energy Services Company (ESCO) can help you avoid paying upfront capital for energy efficiency projects, as they are funded through guaranteed cost savings over the life of your contract. This is a budget neutral financial structure providing customers with an avenue for payment and an immediate justification of their investment.

- Design/Build Programs: Funds for energy efficiency projects become available once capital requirements are met by the business.

- On-bill Funding Programs: Energy efficiency projects are recouped through monthly charges included in an electricity or natural gas supply bill. Constellation’s Efficiency Made Easy® (EME) program is an on-bill funding program that helps customers identify, implement and fund efficiency improvements that can help reduce energy costs, modernize facilities, and meet sustainability goals. You can realize cost savings through a reduction in consumption and an improved load profile, which will positively impact future energy costs and your environmental goals. This unique award-winning solution has helped to fund over $350 million in energy efficiency projects for more than 1,100 customers.

- Alternative Financing Vehicles: Many regions offer alternative financing opportunities through local, state, or federal grants and loans to reduce or eliminate up-front costs to the consumer at standard to below average interest rates. These provide a budget neutral financing approach to upgrade their facilities. A great example of a program like this is C–Pace where the financing is added to their annual property tax.

Monitor and Report on Your Energy Efficiency Programs

Once energy efficiency projects are implemented, utilizing your utility expense management system should make it easy to see tangible changes across your facilities’ footprint. Additionally, some organizations have documented some of the non-financial or operational benefits, such as positive employee and customer feedback.

Take Action Today

Implementing new energy efficiency initiatives—even on a small scale—can initially sound overwhelming. However, investments in energy efficiency will translate into reductions in energy consumption and maintenance expenditures, enhanced system operations, and a reduced carbon footprint. Working with a trusted energy expert like Constellation can help your organization identify, implement, and fund your energy efficiency projects.

- https://www.energy.gov/energysaver/led-lighting

- https://blogs.constellation.com/sustainability/survey-results-top-5-takeaways-from-proactive-energy-leaders-in-managing-their-sustainable-energy-plans

© 2024 Constellation. The offerings described herein, if applicable, are those of either Constellation Navigator, LLC, Constellation NewEnergy, Inc. or Constellation NewEnergy-Gas Division, LLC, affiliates of each other. Brand names and product names are trademarks or service marks of their respective holders. All rights reserved.

The post Efficiency Upgrades: Implementing Energy Savings Projects appeared first on Constellation's Energy4Business Blog.

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://search.yahoo.com/mrss/] => Array ( [content] => Array ( [0] => Array ( [data] => [attribs] => Array ( [] => Array ( [url] => https://blogs.constellation.com/wp-content/uploads/2023/10/Windows-Orange-and-Blue.png [type] => image/png [medium] => image [width] => 3000 [height] => 2000 ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => [child] => Array ( [http://search.yahoo.com/mrss/] => Array ( [title] => Array ( [0] => Array ( [data] => Windows Orange and Blue [attribs] => Array ( [] => Array ( [type] => plain ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [thumbnail] => Array ( [0] => Array ( [data] => [attribs] => Array ( [] => Array ( [url] => https://blogs.constellation.com/wp-content/uploads/2023/10/Windows-Orange-and-Blue-1024x683.png [width] => 640 [height] => 427 ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [copyright] => Array ( [0] => Array ( [data] => Alex Aguiar [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) ) ) ) ) ) ) [2] => Array ( [data] => [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => [child] => Array ( [] => Array ( [title] => Array ( [0] => Array ( [data] => Webinar Analysts: A Record Hot Summer, Data Center Demand and Natural Gas Fundamentals [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [link] => Array ( [0] => Array ( [data] => https://blogs.constellation.com/energy-management/webinar-analysts-a-record-hot-summer-data-center-demand-and-natural-gas-fundamentals/ [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [pubDate] => Array ( [0] => Array ( [data] => Wed, 26 Jun 2024 14:08:25 +0000 [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [category] => Array ( [0] => Array ( [data] => Energy Management [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [1] => Array ( [data] => Natural Gas [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [2] => Array ( [data] => market intel webinar [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [3] => Array ( [data] => natural gas storage [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [4] => Array ( [data] => grid reliability [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [5] => Array ( [data] => NERC [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [6] => Array ( [data] => LNG exports [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [7] => Array ( [data] => data centers [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [8] => Array ( [data] => energy landscape [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [9] => Array ( [data] => summer heat [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [10] => Array ( [data] => AI software [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [11] => Array ( [data] => electricity demand [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [12] => Array ( [data] => power burns [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [13] => Array ( [data] => Mountain Valley Pipeline [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [14] => Array ( [data] => weather patterns [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [15] => Array ( [data] => tropical storms [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [16] => Array ( [data] => market trends [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [guid] => Array ( [0] => Array ( [data] => https://blogs.constellation.com/energy-management/webinar-analysts-summer-outlook-gas-storage-highs-and-future-load-growth-copy/ [attribs] => Array ( [] => Array ( [isPermaLink] => false ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [description] => Array ( [0] => Array ( [data] =>During the June Constellation monthly Energy Market Intelligence Webinar, Constellation’s Commodities Management Group (CMG) provided comprehensive coverage of various significant factors affecting the...

The post Webinar Analysts: A Record Hot Summer, Data Center Demand and Natural Gas Fundamentals appeared first on Constellation's Energy4Business Blog.

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/dc/elements/1.1/] => Array ( [creator] => Array ( [0] => Array ( [data] => Constellation [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/rss/1.0/modules/content/] => Array ( [encoded] => Array ( [0] => Array ( [data] => 3 min readDuring the June Constellation monthly Energy Market Intelligence Webinar, Constellation’s Commodities Management Group (CMG) provided comprehensive coverage of various significant factors affecting the energy landscape. These included insights into the potential hottest summer on record, natural gas fundamentals, summer readiness assessments from NERC, and a deep dive into data centers and their impact in shaping the energy landscape.

Weather Update

The team began the webinar by covering the latest outlooks for the summer, including predictions of potentially record-breaking heat as the U.S. is hit with the first heat wave of the year. The pattern of heat is expected to continue throughout July and August, especially in the Midwest and to the East. The team also discussed the tropical storm outlook as the first named tropical storm, Alberto, is expected to bring rain to South Texas. The tropical storm season is expected to be active, with predictions of around 20 named storms. Other topics included recent volcanic eruption impact on weather patterns, U.S. drought updates and the transition from El Niño to La Niña weather patterns, which will enhance storm activity.

Natural Gas Fundamentals

The panel of energy fundamentals experts discussed the natural gas storage and production picture, which continues to trend bullish. Production has seen slight increases, narrowing the storage surplus, but the potential for a record-high summer temperatures has increased power burns across the U.S. LNG exports are running close to full capacity at 13 Bcf/day Additionally, the Mountain Valley Pipeline (2 Bcf/d), which has faced legal challenges and delays in its construction, was approved by FERC to begin commercial operation on June 11. Volumes on MVP should begin to ramp up to 2 Bcf/d in the coming month.

Data Centers

Steve Chambers from Constellation’s Commercialization & Development team joined this month’s webinar to discuss data centers, one of today’s hottest trends in the energy industry. The number of energy-intensive data centers has exploded over the past few years, largely to meet the growing interest and adoption of artificial intelligence (AI) software. Steve and the team discussed impacts on electricity demand, which is expected to drive overall U.S. electricity load growth higher for the first time in over a decade. They also addressed the challenges data centers and large corporations face in decarbonization while maintaining reliability. Infrastructure development issues such as permitting, grid connection backlogs, and supply chain bottlenecks for renewables and transmission components are also part of the overall challenge that data centers and new electric power generation face.

Summer Reliability Assessments

The team covered the recent Summer Reliability Assessment from the North American Electric Reliability Corporation (NERC). This assessment ensures that power systems are prepared for the high-demand summer season. It evaluates the readiness of power plants, transmission systems and other critical infrastructure to handle peak summer loads and potential challenges such as heat waves or storms. Overall, all regions are generally prepared with resource adequacy to meet normal peak demand this summer.

However, there are seven areas facing ‘elevated risk’ of shortfalls due to rising demand, generator retirements, unplanned outages, drought, and the potential for low wind performance. The grid is increasingly having to deal with the challenge of “net load” during sunset hours. Net load is overall grid demand minus intermittent generation, primarily from solar and wind sources. From the hours of 7 to 9 pm, as solar activity declines, the overall grid load remains elevated. This means that the load served by thermal generation, or batteries can increase rapidly. Additionally, the variability of wind generation keeps grid operators on their toes on some summer evenings.

We invite you to join us for our next Energy Market Intel Webinar on Wednesday, July 17th at 2 pm ET. Constellation energy experts will offer detailed and timely updates on factors affecting energy landscape such as weather, natural gas storage and production, and domestic and global economic conditions. Register by visiting www.constellation.com/marketintelwebinar.

© 2024 Constellation. The offerings described herein, if applicable, are those of either Constellation NewEnergy, Inc. or Constellation NewEnergy-Gas Division, LLC, affiliates of each other. Brand names and product names are trademarks or service marks of their respective holders. All rights reserved. The views, thoughts and opinions expressed in the webcast by each participant belong solely to the speaker and not necessarily to the speaker’s employer (including Constellation Energy Corporation or any of its affiliates), organization, committee or other group or individual. Constellation does not make and expressly disclaims, any express or implied guaranty, representation or warranty regarding any opinions or statements set forth herein or in the webcast. Constellation shall not be responsible for any reliance upon any information, opinions, or statements contained in the webcast or for any omission or error of fact.

The post Webinar Analysts: A Record Hot Summer, Data Center Demand and Natural Gas Fundamentals appeared first on Constellation's Energy4Business Blog.

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://search.yahoo.com/mrss/] => Array ( [content] => Array ( [0] => Array ( [data] => [attribs] => Array ( [] => Array ( [url] => https://blogs.constellation.com/wp-content/uploads/2024/06/Office-Building-People.png [type] => image/png [medium] => image [width] => 4256 [height] => 1926 ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => [child] => Array ( [http://search.yahoo.com/mrss/] => Array ( [title] => Array ( [0] => Array ( [data] => Office Building People [attribs] => Array ( [] => Array ( [type] => plain ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [thumbnail] => Array ( [0] => Array ( [data] => [attribs] => Array ( [] => Array ( [url] => https://blogs.constellation.com/wp-content/uploads/2024/06/Office-Building-People-1024x463.png [width] => 640 [height] => 289 ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [copyright] => Array ( [0] => Array ( [data] => Alex Aguiar [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) ) ) ) ) ) ) [3] => Array ( [data] => [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => [child] => Array ( [] => Array ( [title] => Array ( [0] => Array ( [data] => Data + Analytics: Connecting Energy Usage to Your Business Goals [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [link] => Array ( [0] => Array ( [data] => https://blogs.constellation.com/roadmap-to-sustainability/data-analytics-connecting-energy-usage-to-your-business-goals/ [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [pubDate] => Array ( [0] => Array ( [data] => Mon, 17 Jun 2024 13:20:17 +0000 [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [category] => Array ( [0] => Array ( [data] => Roadmap to Sustainability [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [1] => Array ( [data] => Energy Efficiency [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [2] => Array ( [data] => sustainability goals [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [3] => Array ( [data] => energy trends [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [4] => Array ( [data] => utility bill management [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [5] => Array ( [data] => Energy expenses [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [6] => Array ( [data] => Operating costs [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [7] => Array ( [data] => Energy consumption data [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [8] => Array ( [data] => Cost optimization [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [9] => Array ( [data] => Utility costs [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [10] => Array ( [data] => Energy usage analysis [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [11] => Array ( [data] => Utility bill verification [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [12] => Array ( [data] => Energy benchmarking [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [13] => Array ( [data] => Energy consumption optimization [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [14] => Array ( [data] => Energy management platform [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [15] => Array ( [data] => Energy savings strategies [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [16] => Array ( [data] => Constellation Navigator [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [guid] => Array ( [0] => Array ( [data] => https://blogs.constellation.com/?p=7596 [attribs] => Array ( [] => Array ( [isPermaLink] => false ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [description] => Array ( [0] => Array ( [data] =>After you understand the different types of organizational emissions, and you have begun to set your sustainability goals, it is time...

The post Data + Analytics: Connecting Energy Usage to Your Business Goals appeared first on Constellation's Energy4Business Blog.

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/dc/elements/1.1/] => Array ( [creator] => Array ( [0] => Array ( [data] => Constellation [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/rss/1.0/modules/content/] => Array ( [encoded] => Array ( [0] => Array ( [data] => 2 min readAfter you understand the different types of organizational emissions, and you have begun to set your sustainability goals, it is time to develop an actionable strategy to achieve those goals. However, you can only proactively manage utility costs, understand trends, and develop strategies to optimize spend once you take control of your most significant asset: your energy consumption data.

Analyzing data can be time-consuming, costly and challenging–and very few companies are equipped to handle this in-house. Utility bill management platforms have become increasingly important tools for understanding energy expenses, finding areas of efficiency, and streamlining and reducing operating costs.

Utility bill management platforms provide detailed insights into energy usage. This allows companies to identify areas of high energy usage and to take steps to streamline and reduce operating costs in those areas. At a high level, these platforms allow companies to aggregate, simplify and ultimately optimize their energy usage and identify trends including:

- Aggregate and verify utility bills: Manually reviewing utility bills across multiple providers creates room for errors. These platforms can compile all line items on energy bills to create a standardized review and analysis of usage, as well as verify each line item for accuracy. These platforms should compare and verify the utility tariffs for a company’s facility.

- Simplify user experience. The best utility bill management platforms provide an intuitive user experience. Standardizing energy bills across multiple utilities provides a simpler review and analysis of energy usage and expenses. Further, the platforms can create a comprehensive expense profile with custom reporting on data based on tailored goals.

- Generate detailed reports and analytics. Beyond simplifying the user experience, utility bill management platforms provide that baseline and insights into areas for improvement or energy efficiency opportunities, especially for a franchise, university or other organization with large-footprint and widespread energy consumption. Data insights can compare various facilities to identify trends, changes or anomalies in energy usage, then inform strategies for optimization.

Among these increasingly popular utility management platforms is Constellation Navigator’s Utility Bill Management Platform (UBM), which is a fully automated solution, proactively managing utility costs, understanding trends, and developing strategies to optimize spend. For example, a company could leverage Constellation Navigator’s UBM platform to identify areas where lighting is left on unnecessarily and implement a policy of turning off lights when they are not needed.

Constellation Navigator’s UBM platform can help companies benchmark their energy usage against those of similar-sized companies in their industry. Companies can identify areas where they are using more energy than their peers and take steps to reduce their usage.

Utility bill management platforms provide a range of benefits for companies looking to manage their energy usage. These platforms give companies power to take control and turn your utility data into one of your most valuable assets, proactively manage utility costs, understand trends, and develop strategies to optimize spend across the entire billing and payment lifecycle.

To start proactively taking control of your energy data with Constellation Navigator’s UBM platform, contact us today.

Take Action Today

Ready to work with energy experts who have the tools to easily connect your energy usage to your sustainability goals? Constellation can help your organization set a pathway to a more sustainable future.

Learn more about building your sustainability roadmap with our new white paper

The post Data + Analytics: Connecting Energy Usage to Your Business Goals appeared first on Constellation's Energy4Business Blog.

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://search.yahoo.com/mrss/] => Array ( [content] => Array ( [0] => Array ( [data] => [attribs] => Array ( [] => Array ( [url] => https://blogs.constellation.com/wp-content/uploads/2020/11/pear_hero-scaled.jpg [type] => image/jpeg [medium] => image [width] => 2560 [height] => 711 ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => [child] => Array ( [http://search.yahoo.com/mrss/] => Array ( [title] => Array ( [0] => Array ( [data] => pear_hero [attribs] => Array ( [] => Array ( [type] => plain ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [thumbnail] => Array ( [0] => Array ( [data] => [attribs] => Array ( [] => Array ( [url] => https://blogs.constellation.com/wp-content/uploads/2020/11/pear_hero-1024x284.jpg [width] => 640 [height] => 178 ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [copyright] => Array ( [0] => Array ( [data] => Julie Haviland [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) ) ) ) ) ) ) [4] => Array ( [data] => [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => [child] => Array ( [] => Array ( [title] => Array ( [0] => Array ( [data] => How to Effectively Manage Your Natural Gas Strategy [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [link] => Array ( [0] => Array ( [data] => https://blogs.constellation.com/energy-management/how-to-effectively-manage-your-natural-gas-strategy/ [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [pubDate] => Array ( [0] => Array ( [data] => Thu, 30 May 2024 15:45:09 +0000 [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [category] => Array ( [0] => Array ( [data] => Energy Management [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [1] => Array ( [data] => renewable energy [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [2] => Array ( [data] => innovative technologies [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [3] => Array ( [data] => carbon emissions reduction [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [4] => Array ( [data] => carbon offsets [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [5] => Array ( [data] => Constellation Energy [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [6] => Array ( [data] => Reliable energy solutions [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [7] => Array ( [data] => Affordable energy options [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [8] => Array ( [data] => Energy managers [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [9] => Array ( [data] => Energy buyers [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [10] => Array ( [data] => Facility managers [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [11] => Array ( [data] => Natural gas usage [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [12] => Array ( [data] => Sustainability initiatives [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [13] => Array ( [data] => Managed Portfolio Service (MPS) [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [14] => Array ( [data] => Renewable Natural Gas (RNG) [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [15] => Array ( [data] => Low carbon intensity solutions. [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [guid] => Array ( [0] => Array ( [data] => https://blogs.constellation.com/roadmap-to-sustainability/using-carbon-accounting-to-drive-actionable-sustainability-strategies-copy/ [attribs] => Array ( [] => Array ( [isPermaLink] => false ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [description] => Array ( [0] => Array ( [data] =>Today, energy managers are challenged with maintaining the reliability and affordability of their businesses’ energy while also making efforts to...

The post How to Effectively Manage Your Natural Gas Strategy appeared first on Constellation's Energy4Business Blog.

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/dc/elements/1.1/] => Array ( [creator] => Array ( [0] => Array ( [data] => Constellation [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/rss/1.0/modules/content/] => Array ( [encoded] => Array ( [0] => Array ( [data] => 4 min readToday, energy managers are challenged with maintaining the reliability and affordability of their businesses’ energy while also making efforts to reduce carbon emissions. Natural gas continues to help meet demand as the nation addresses the challenges of the energy transition to a carbon-free future. The use of innovative technologies in low carbon intensity solutions enables us to have reliable access to energy sources while simultaneously reducing emissions associated with natural gas usage. This approach helps bridge the gap in achieving rapid carbon emission reduction goals without compromising on reliability or affordability.

Navigating the Energy Landscape

At Constellation, we are committed to advancing clean energy initiatives to accelerate the transition to a carbon-free future. While sustainability is a top priority, ensuring reliability for the customers we serve is also important. There can be challenges when it comes to producing renewable energy from solar farms and wind turbines, as weather conditions can affect power availability. By offering a nuanced approach with a diverse portfolio that includes both renewable and reliable options, Constellation ensures that customers can power their operations 24/7 while serving the current energy landscape.

Natural gas is still an affordable, versatile and reliable energy source that complements renewables in our transition to a low-carbon future. With a large customer base of gas consumers, supported by our gas-fired power plants, Constellation can provide flexible baseload power that fills in the gaps when renewable energy fluctuates in reliability.

Energy managers can use various strategies to ensure the reliability and affordability of their natural gas supply while also making strides to decarbonize their supply and work towards a more sustainable future.

A Managed Approach to Natural Gas Purchasing

Many businesses and organizations have shifted their focus from more than just price. Strategic risk management of both NYMEX and basis costs helps support long-term budget certainty and protects against price volatility. Constellation’s Managed Portfolio Service (MPS) is a targeted approach that helps customers manage their basis price risk through modified-cost averaging and pooling. Basis can vary widely based on location due to local supply and demand factors. The program can cover all or just some of the total usage volumes at a facility. This type of purchasing strategy is ideal for organizations looking for innovative ways to manage and diversify their purchasing risk. Options include:

- Management of Total Usage: Allows the program to take care of any changes in usage, even when usage exceeds monthly nominations.

- Management of Specific Nominations: Allows the customer flexibility to decide what volume will be run through the program and what volume they will manage on their own.

- Management of Incrementals: Allows customers to lock in basis costs; MPS can help manage incremental costs.

Natural Gas Sustainability

For businesses looking to decarbonize their current natural gas supply, Constellation can help you achieve long-term sustainability goals by seamlessly integrating carbon offsets or Renewable Natural Gas (RNG) into your natural gas procurement strategies.

Carbon offsets are a low-cost option for businesses looking to start their sustainability journey that may lack the capital to implement full-scale carbon-reduction projects. Carbon offsets represent a verified reduction in emissions of carbon dioxide, or other greenhouse gas emissions, made elsewhere through forestry, energy efficiency, industrial process improvements and carbon capture and sequestration projects.

On the other hand, Renewable Natural Gas (RNG) is physical pipeline-quality natural gas derived from the decomposition of organic matter plus associated environmental attributes. It begins as raw biogas which is then purified to meet applicable pressure, quality and heat content requirements before being injected into a pipeline, like regular natural gas.

The environmental attributes associated with RNG, which include reduced carbon emissions as compared to fossil-derived natural gas, can be paired with end-users’ natural gas consumption to allow end-users to make renewable energy claims associated with natural gas use. Specific sustainability claims and emission reduction levels will depend upon the specific end-use of the natural gas and the chosen GHG emission reporting standards. A business’s purchase of RNG attributes may also reduce Scope 1 carbon emissions replaced by biogenic sources, without the need to modify existing infrastructure.

Shaping the Future of Energy

Constellation continues to provide low-carbon intensity solutions that bridge the gap to the future as we address net-zero emissions goals. Governments are putting in place more legislation supporting low carbon fuel standards (LCFS) and accelerating both innovation and affordability.

Looking ahead, we envision renewables and natural gas continuing to work together sustainably. Our strategy involves expanding renewable energy capacity while investing in gas infrastructure upgrades and emissions reduction technologies. This balanced approach navigates the energy transition while upholding environmental stewardship.

Comprehensive Energy Solutions with Constellation

Constellation is committed to offering a mix of solutions to help customers meet their energy goals. Constellation provides a range of offerings, from supplying power and natural gas to a suite of sustainability projects and reporting solutions.

With Constellation, you gain more than just an energy provider. You have an integrator who can manage all aspects of your energy needs, empowering you to focus on your core business while we help you navigate the complexities of sustainable energy solutions. Explore our comprehensive product mix to address these challenges and help your business achieve its goals.

© 2024 Constellation. The offerings described herein, if applicable, are those of either Constellation Navigator, LLC, Constellation NewEnergy, Inc. or Constellation NewEnergy-Gas Division, LLC, affiliates of each other. Brand names and product names are trademarks or service marks of their respective holders. All rights reserved.

The post How to Effectively Manage Your Natural Gas Strategy appeared first on Constellation's Energy4Business Blog.

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://search.yahoo.com/mrss/] => Array ( [content] => Array ( [0] => Array ( [data] => [attribs] => Array ( [] => Array ( [url] => https://blogs.constellation.com/wp-content/uploads/2019/02/CAMPAIGN_Cenralized_ManufacturingGas_NighttimePlantLights.jpg [type] => image/jpeg [medium] => image [width] => 6000 [height] => 4000 ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => [child] => Array ( [http://search.yahoo.com/mrss/] => Array ( [title] => Array ( [0] => Array ( [data] => Oil and gas refinery plant area at night [attribs] => Array ( [] => Array ( [type] => plain ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [thumbnail] => Array ( [0] => Array ( [data] => [attribs] => Array ( [] => Array ( [url] => https://blogs.constellation.com/wp-content/uploads/2019/02/CAMPAIGN_Cenralized_ManufacturingGas_NighttimePlantLights-1024x683.jpg [width] => 640 [height] => 427 ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [copyright] => Array ( [0] => Array ( [data] => Amanda Donohue [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) ) ) ) ) ) ) [5] => Array ( [data] => [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => [child] => Array ( [] => Array ( [title] => Array ( [0] => Array ( [data] => Using Carbon Accounting to Drive Actionable Sustainability Strategies [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [link] => Array ( [0] => Array ( [data] => https://blogs.constellation.com/roadmap-to-sustainability/using-carbon-accounting-to-drive-actionable-sustainability-strategies/ [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [pubDate] => Array ( [0] => Array ( [data] => Tue, 28 May 2024 13:30:13 +0000 [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [category] => Array ( [0] => Array ( [data] => Roadmap to Sustainability [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [1] => Array ( [data] => Sustainability [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [2] => Array ( [data] => greenhouse gas emissions [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [3] => Array ( [data] => carbon emissions reduction [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [4] => Array ( [data] => scope 1 emissions [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [5] => Array ( [data] => scope 2 emissions [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [6] => Array ( [data] => scope 3 emissions [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [7] => Array ( [data] => greenhouse gas accounting [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [8] => Array ( [data] => carbon accounting [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [9] => Array ( [data] => ghg [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [guid] => Array ( [0] => Array ( [data] => https://blogs.constellation.com/energy-management/the-components-of-natural-gas-price-and-effective-purchasing-strategies-copy/ [attribs] => Array ( [] => Array ( [isPermaLink] => false ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [description] => Array ( [0] => Array ( [data] =>As businesses target climate action and sustainability as part of their overall energy goals, it can be challenging to understand...

The post Using Carbon Accounting to Drive Actionable Sustainability Strategies appeared first on Constellation's Energy4Business Blog.

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/dc/elements/1.1/] => Array ( [creator] => Array ( [0] => Array ( [data] => Constellation [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/rss/1.0/modules/content/] => Array ( [encoded] => Array ( [0] => Array ( [data] => 2 min readAs businesses target climate action and sustainability as part of their overall energy goals, it can be challenging to understand and calculate your company’s carbon footprint due to the evolving complexity of the process and lack of the right tools and resources. To achieve meaningful sustainability progress, it is essential to have accurate and comprehensive carbon accounting systems in place.

Carbon accounting, also known as greenhouse gas (GHG) accounting, is the process of measuring, reporting, and verifying the amount of GHGs emitted or removed from the atmosphere by a business’s activity. Greenhouse gases are emitted from a range of sources, including transportation, electricity generation, agriculture, and industrial processes.

Why Use Carbon Accounting?

Carbon accounting is necessary for several reasons. Firstly, it helps to identify the main sources of GHG emissions, allowing businesses to target their mitigation efforts effectively. Secondly, it provides a basis for tracking progress towards emission reduction targets. Finally, it allows businesses to report their emissions, either voluntarily or as required by federal or state reporting laws in New York City, Chicago, Philadelphia, and Washington D.C., among others.

How does Carbon Accounting Work?

The greenhouse gas accounting process typically involves the following steps:

Identifying the sources of GHG emissions: This involves identifying the activities that generate GHG emissions, such as the use of fossil fuels for transportation or the use of electricity in buildings.

Collecting data on the activity: This involves collecting data on the physical activity that generates emissions, such as the amount of fuel consumed by a vehicle, or the amount of electricity consumed by a building.

Calculating the emissions: This involves using emission factors or other calculation methods to estimate the amount of GHG emissions generated by the activity.

Verifying the emissions: This involves verifying the reported emissions through independent auditing or other verification methods to ensure their accuracy and completeness.

Reporting the emissions: This involves reporting the calculated emissions to relevant stakeholders, such as governments, businesses, or international bodies.

The Constellation Navigator Solution

The major challenge of greenhouse gas accounting is the availability of quality data. Collecting accurate data on activities that generate GHG emissions can be difficult, particularly for smaller businesses or businesses with multiple facilities across various geographies. Additionally, the accuracy of emission factors and other calculation methods can be affected by a range of factors, including the age and condition of equipment, the quality of fuel used, and the weather conditions at the time of measurement.

Constellation Navigator’s carbon accounting platform allows companies to seamlessly develop a baseline of their carbon emissions, report it across multiple frameworks, and identify and prioritize carbon reduction or mitigation strategies for implementation. Our solution will help you track your climate targets, projects, and budgets in one place to clearly communicate with stakeholders.

Carbon accounting is a helpful tool for addressing the climate crisis. Accurate and comprehensive carbon accounting systems provide a basis for effective climate policies and strategic sustainability efforts and can help to drive the transition to a low-carbon economy. As such, it is important for businesses to invest in the development and implementation of robust carbon accounting.

© 2024 Constellation. The offerings described herein, if applicable, are those of either Constellation Navigator, LLC, Constellation NewEnergy, Inc. or Constellation NewEnergy-Gas Division, LLC, affiliates of each other. Brand names and product names are trademarks or service marks of their respective holders. All rights reserved.

The post Using Carbon Accounting to Drive Actionable Sustainability Strategies appeared first on Constellation's Energy4Business Blog.

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://search.yahoo.com/mrss/] => Array ( [content] => Array ( [0] => Array ( [data] => [attribs] => Array ( [] => Array ( [url] => https://blogs.constellation.com/wp-content/uploads/2023/05/images_grass.jpg [type] => image/jpeg [medium] => image [width] => 1500 [height] => 600 ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => [child] => Array ( [http://search.yahoo.com/mrss/] => Array ( [title] => Array ( [0] => Array ( [data] => _images_grass [attribs] => Array ( [] => Array ( [type] => plain ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [thumbnail] => Array ( [0] => Array ( [data] => [attribs] => Array ( [] => Array ( [url] => https://blogs.constellation.com/wp-content/uploads/2023/05/images_grass-1024x410.jpg [width] => 640 [height] => 256 ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [copyright] => Array ( [0] => Array ( [data] => Alex Aguiar [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) ) ) ) ) ) ) [6] => Array ( [data] => [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => [child] => Array ( [] => Array ( [title] => Array ( [0] => Array ( [data] => Establishing your GHG Emissions Baseline [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [link] => Array ( [0] => Array ( [data] => https://blogs.constellation.com/sustainability/establishing-your-ghg-emissions-baseline/ [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [pubDate] => Array ( [0] => Array ( [data] => Wed, 22 May 2024 14:00:23 +0000 [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [category] => Array ( [0] => Array ( [data] => Roadmap to Sustainability [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [1] => Array ( [data] => Sustainability & Energy Efficiency [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [2] => Array ( [data] => Sustainability [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [3] => Array ( [data] => greenhouse gas emissions [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [4] => Array ( [data] => GHG emissions [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [5] => Array ( [data] => roadmap to sustainability [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [6] => Array ( [data] => ghg [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [7] => Array ( [data] => science based targets [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) [8] => Array ( [data] => Sustainability Whitepaper Series [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [guid] => Array ( [0] => Array ( [data] => https://blogs.constellation.com/energy-management/how-to-leverage-rebates-for-energy-efficiency-projects-copy/ [attribs] => Array ( [] => Array ( [isPermaLink] => false ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [description] => Array ( [0] => Array ( [data] =>Energy sustainability is no longer a lofty buzzword, but is in fact, an increasingly important factor in achieving long-term success....

The post Establishing your GHG Emissions Baseline appeared first on Constellation's Energy4Business Blog.

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/dc/elements/1.1/] => Array ( [creator] => Array ( [0] => Array ( [data] => Constellation [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/rss/1.0/modules/content/] => Array ( [encoded] => Array ( [0] => Array ( [data] => 3 min readEnergy sustainability is no longer a lofty buzzword, but is in fact, an increasingly important factor in achieving long-term success. Even if your organization has set goals, designing and executing a robust sustainability plan can be complicated. Building an effective plan requires consideration for evolving technology and clean energy supply options. It requires balancing investment in the future while keeping tight to the budget now. These challenges make it clear: reducing emissions requires more than the right mindset. It requires a sustainability roadmap that clearly and transparently lays out how to properly execute and meet your objectives. In this blog series, Constellation will help guide you through the various steps to developing effective sustainability strategies.

As organizations strive to embrace a more sustainable future, establishing a greenhouse gas (GHG) emissions baseline is a crucial starting point. Greenhouse gases are emitted by many sources and are classified as either Scope 1, 2, or 3 emissions. Scope 1 emissions are the direct emissions from an entity’s operations while Scope 2 emissions are the indirect emissions from an entity’s purchased utilities. Multiple solutions exist to help reduce Scope 1 and 2 emissions. Scope 3 emissions occur in the value chain of an entity, such as upstream emissions from suppliers, downstream emissions from customers using their products, or emissions associated with the business travel or commuting of an entity’s employees. Scope 3 is quickly gaining more attention as many companies look for even more leadership opportunities in the climate space by setting targets on their value chain emissions. A GHG emissions baseline serves as a foundation for understanding an organization’s current emissions profile that can lead to enabling informed decision-making, target setting, and effective implementation of emissions reduction strategies.

According to a 2022 ESG Global Study, companies that demonstrate progress toward environmental sustainability, like clearly reporting their GHG emissions, have found more success than they might have if they had not seen progress: some 87% of consumers want to spend more with them and 83% of potential investors want to back them financially. Transparent reporting attracts and retains workforce talent, too. 83% of employees surveyed shared that they want to work for employers and brands that take environmental and social issues seriously.1

To begin, a business or organization can depend on several areas of guidance and methodologies to help them define appropriate GHG reduction targets.

Self-Defined GHG Emissions Targets

Many organizations have set self-defined GHG emissions targets, such as Constellation’s own climate commitments. These goals typically focus on reducing emissions by a certain percentage from their baseline emissions by a specific deadline. For example, a company might set an absolute target to reduce 50% of their 2020 emissions by 2050. Without first gathering the data and calculating the 2020 emissions baseline, it is impossible to quantify progress or measure success. It is also common for organizations to set multiple goals, milestones, or intensity targets where they might track emissions against a different benchmark such as headcount or production (for example, metric tons emitted per widget produced).

Self-defined GHG targets may be established for various reasons, such as corporate social responsibility, environmental sustainability goals, or to demonstrate leadership in addressing climate change. These targets are completely voluntary and allow organizations to demonstrate their commitment to a sustainable future.

Federal, State or Local Requirements

While an increasing number of organizations have voluntarily been working towards self-defined GHG targets, certain federal, state and local laws are being introduced that require organizations to report GHG emissions or achieve certain reductions. The United States Federal Government requires entities with sources that emit at least 25,000 metric tons of carbon dioxide equivalent to report resulting GHG emissions for those facilities to the Environmental Protection Agency (EPA) annually.2

Additionally, 24 states plus the District of Columbia have adopted specific GHG reduction targets to address climate change3. Even specific cities such as New York City, Washington D.C., Chicago and Philadelphia, require businesses to track their energy consumption and some also require yearly reports. To learn about your state’s requirements, visit: https://www.c2es.org/content/state-climate-policy/

Science Based Targets

The science-based target approach provides a framework for setting GHG reduction goals and avoiding the most severe impacts of climate change. Reduction efforts follow the latest climate science and the objective of limiting global warming to well below 1.5degrees Celsius above pre-industrial levels, as outlined in the Paris Agreement5. These targets are typically developed using scientific models and scenarios that project the level of emissions reductions necessary to achieve specific temperature goals.

To learn more about sector-specific goals or how your organization can begin to set science-based emissions reduction targets, visit: https://sciencebasedtargets.org.

Take Action Today

Working with a trusted energy expert like Constellation can help your organization establish actionable and attainable GHG benchmarks for meaningful sustainability initiatives and positions you as a responsible and forward-thinking leader in addressing the pressing challenges of the climate.

Learn more about building your sustainability roadmap with our new white paper

1: https://www.oracle.com/a/ocom/docs/applications/esg-study-no-planet-b-report.pdf

2: https://www.epa.gov/sites/default/files/2014-09/documents/ghgrp-overview-factsheet.pdf

3: https://www.oracle.com/a/ocom/docs/applications/esg-study-no-planet-b-report.pdf

4: https://www.govinfo.gov/content/pkg/FR-2022-04-11/pdf/2022-06342.pdf

5: https://sciencebasedtargets.org/news/sbti-raises-the-bar-to-1-5-c

The post Establishing your GHG Emissions Baseline appeared first on Constellation's Energy4Business Blog.

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://search.yahoo.com/mrss/] => Array ( [content] => Array ( [0] => Array ( [data] => [attribs] => Array ( [] => Array ( [url] => https://blogs.constellation.com/wp-content/uploads/2018/02/Aiming-for-Company-Growth-It-Starts-With-Energy-Management-1.jpg [type] => image/jpeg [medium] => image [width] => 967 [height] => 398 ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => [child] => Array ( [http://search.yahoo.com/mrss/] => Array ( [title] => Array ( [0] => Array ( [data] => Aiming for Company Growth? It Starts With Energy Management [attribs] => Array ( [] => Array ( [type] => plain ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [thumbnail] => Array ( [0] => Array ( [data] => [attribs] => Array ( [] => Array ( [url] => https://blogs.constellation.com/wp-content/uploads/2018/02/Aiming-for-Company-Growth-It-Starts-With-Energy-Management-1.jpg [width] => 640 [height] => 263 ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [copyright] => Array ( [0] => Array ( [data] => Adrienne Anderson [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) ) ) ) ) ) ) [7] => Array ( [data] => [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => [child] => Array ( [] => Array ( [title] => Array ( [0] => Array ( [data] => Scope 1, 2 and 3 Emissions: What to Address First in Your GHG Reduction Journey [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [link] => Array ( [0] => Array ( [data] => https://blogs.constellation.com/roadmap-to-sustainability/scope-1-2-and-3-emissions-what-to-address-first-in-your-ghg-reduction-journey/ [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [pubDate] => Array ( [0] => Array ( [data] => Fri, 10 May 2024 14:30:57 +0000 [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [category] => Array ( [0] => Array ( [data] => Roadmap to Sustainability [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [guid] => Array ( [0] => Array ( [data] => https://blogs.constellation.com/?p=8036 [attribs] => Array ( [] => Array ( [isPermaLink] => false ) ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) [description] => Array ( [0] => Array ( [data] =>Climate change is driven by increasing greenhouse gas (GHG) emissions, like carbon dioxide, methane, and nitrous oxide, which trap heat...

The post Scope 1, 2 and 3 Emissions: What to Address First in Your GHG Reduction Journey appeared first on Constellation's Energy4Business Blog.

[attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/dc/elements/1.1/] => Array ( [creator] => Array ( [0] => Array ( [data] => Constellation [attribs] => Array ( ) [xml_base] => [xml_base_explicit] => [xml_lang] => ) ) ) [http://purl.org/rss/1.0/modules/content/] => Array ( [encoded] => Array ( [0] => Array ( [data] => 5 min readClimate change is driven by increasing greenhouse gas (GHG) emissions, like carbon dioxide, methane, and nitrous oxide, which trap heat in the atmosphere. These gases are released into the atmosphere, often from business operations, including, but not limited to, power usage for facilities, transportation of goods, and industrial manufacturing processes. Climate change is one of the most urgent challenges facing businesses today. As public awareness grows around this issue, major corporations are looking to reduce their carbon footprint and lessen their emissions impacts.

More businesses are also taking inventory of their greenhouse gas (GHG) emissions sources, either direct or indirect, to find areas of improvement in order to comply with disclosure rules, set targets, and better align mitigation and adaptation strategies.

Companies are also implementing their own aggressive business-wide sustainability goals to become leaders in their respective industries and to access the growing list of economic, environmental and social benefits of doing so. As another critical component of goal setting, many businesses are creating target dates (e.g., 50% or 100% emissions-free by year 2030 or 2040) to maintain accountability in reaching their emission reduction goals.

The first key step is understanding the different categories of emissions associated with business operations. Before your business implements targeted strategies for reduction, let’s dive into the emissions, categorized into three scopes:

- Scope 1 emissions: Originate from sources owned or controlled by the company.

- Scope 2 emissions: Arise from fossil fuel consumption for power, such as power plants providing purchased electricity.

- Scope 3 emissions: Come from indirect sources, such as company travel and supply chain management.

These emissions are defined by the GHG Protocol, which is widely recognized and used as the international standard for measuring and managing greenhouse gas emissions.

Starting with Scope 1 Emissions

Scope 1 emissions comprise of sources from a business’s owned or controlled assets, and upgrades to these areas are typically the most feasible to measure, control and reduce. These emissions can be separated into four primary categories:

Stationary Combustion: Emissions resulting from the on-site burning of fuels to power equipment like boilers, generators furnaces and more. Examples of these fuels are natural gas, propane, gasoline, diesel, biomass and wood.

Mobile Combustion: Emissions arising from fuel burned by vehicles that are owned or leased by a company, including transportation fleets.

Fugitive Emissions: Emissions from unintentional leaks and releases of greenhouse gases such as refrigeration, air conditioning and fire suppression systems that may leak chemicals.

Process Emissions: Emissions generated directly from industrial activities and chemical reactions in heavy industry and manufacturing plants.

Measuring and reducing scope 1 emissions is foundational to any corporate carbon management strategy. Businesses can implement various energy solutions, such as enhancing energy efficiency, incorporating electric vehicles (EVs) into their fleet, or incorporating renewable natural gas (RNG) into your energy supply, to curtail these emissions effectively.

Scope 2 Emissions

Scope 2 emissions represent indirect greenhouse gas emissions associated with purchased electricity, steam, heating and cooling used to power company operations. These emissions, although physically occurring at the facility where they are generated, are included in an organization’s GHG inventory because they stem from the organization’s energy use, as highlighted by the EPA.1

When accounting for scope 2 emissions from purchased electricity, businesses have two primary approaches:

Location-Based Method: Assesses average emission factors for your regional utility grids supplying your company’s facilities. It provides insights into the general carbon intensity of electricity where your company operates.

Market-Based Method: Reflects emissions from electricity that companies have purposefully chosen. It inventories emissions via contractual instruments, which include any type of contract between two parties for the sale and purchase of energy bundled with attributes about the energy generation, or for unbundled attributes.

Scope 2 emissions may also include purchased heating and cooling that companies purchase from their utility or energy suppliers.

Reducing scope 2 emissions involves voluntarily matching electricity supply requirements with a carbon-free power generation source, which supports the use of emission-free electricity and demonstrates a commitment to the environment. Other strategies to reduce scope 2 emissions include: energy efficiency measures, implementation of on-site generation, purchasing renewable energy certificates (RECs) or emissions free energy certificates (EFECs) and enhanced grid interaction.

Scope 3 Emissions

Scope 3 emissions encompass all other indirect GHG emissions associated with upstream and downstream activities across a company’s supply chain. These emissions, though indirect, play a significant role in contributing to a company’s total carbon footprint. Key components of scope 3 emissions include:

Upstream Emissions

Upstream emissions refer to indirect emissions associated with activities occurring before the product or service reaches the company’s operations. These emissions include:

- Purchased goods and services

- Capital goods

- Fuel and energy related activities

- Transportation and distribution from company suppliers

- Waste from operations

- Business travel

- Employee commuting

- Assets leased by the company

Downstream Emissions

Downstream emissions refer to indirect emissions associated with activities occurring after the product or service leaves the company’s operations and is used or disposed of by customers or end-users. These emissions include:

- Transportation and distribution from company to distributors, retailers and end users

- Processing sold products

- Use of sold products, both products that directly or indirectly consume energy

- End-of-life treatment of sold products

- Assets owned by the company but leased to other companies

- Franchises

- Investments

Steps to reduce scope 3 emissions are often complex and require mindful and strategic action. Reduction efforts involve choosing more sustainable vendors and encouraging existing ones to engage in more sustainable practices. Businesses may implement a scope 3 or GHG materiality threshold to better understand their emissions. A scope 3 or GHG materiality threshold is designed to help companies identify and understand the relative importance of specific ESG and sustainability topics and is typically looked at through two lenses: potential impact on the organization and importance to stakeholders. Completing a scope 3 or GHG materiality threshold is a key step to take in order determine which emissions can be considered ’material’ to your climate disclosure and keep stakeholders up to date on scope 3 emissions.

While scope 3 emissions are indirect, they often account for the majority of a company’s total emissions. Scope 3 measurement and reporting is still in its early stages and is likely the most difficult scope to address for reduction. Since scope 3 emissions are indirect, it is difficult to gain primary emissions data for activities outside of a business’s normal operations. Additionally, reducing scope 3 emissions relies on influencing external partners and vendors across a business’s value chain to report and reduce their emissions.

Optimize Your Emissions Reduction Strategy

The path to comprehensive emissions measurement and reduction is complex, requiring a customized approach tailored to each company’s operations, budget, goals and timeline. By taking a proactive, multi-pronged approach to emissions reduction, businesses can effectively shrink their emissions and environmental impact.

Addressing climate change and reducing greenhouse gas emissions are critical challenges that businesses must tackle head-on. By understanding the different categories of emissions and implementing targeted strategies across scopes 1, 2 and 3, businesses can make significant progress in shrinking their carbon footprints.