In 2020, the COVID-19 pandemic brought unprecedented volatility and uncertainty to energy markets, which our experts detailed early last year and provided guidance for our customers. Electricity usage fell by up to 20% during the stay-at-home orders and crude oil prices fell to a negative value for the first time. But those low prices were only temporary. And today, energy managers are beginning to see the permanent consequences of the pandemic on energy prices.

Now is the time for energy managers to reevaluate their FY2022 energy budgeting approach. They should ensure that they are taking every opportunity to reduce their risk over time.

“The pandemic has been a unique challenge for all energy budgets,” said Mark Huston, President of Constellation’s National Retail Energy Business. “But if seized upon as an opportunity to make needed changes, organizations can position themselves to be more resilient to future market volatility.”

The long-term effects of COVID-19 on energy purchasing

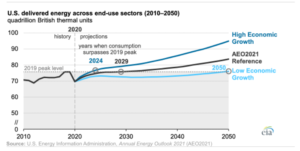

The 2020 energy price downturn will have long-lasting effects as the total U.S. energy consumption is not projected to return to 2019 levels until 2029. Oil producers are taking steps to reduce their financial risk and avoid the volatility they experienced last year. They are moving away from continuous production to prevent overproduction—which will drive prices upward—and adjusting their contract pricing mechanisms to shift more risk to suppliers through demand-based charges.

The power mix temporarily shifted more toward renewables during the lockdowns, and U.S. renewable energy infrastructure investments are expected to continue, driven by sustainability initiatives and favorable government policies that incentivize the adoption of renewables and carbon reduction.

Meanwhile, many organizations are facing tighter budgets. About 80% of manufacturers—who use one-third of all energy in the U.S.—believe the pandemic will have a lasting impact on their businesses.

Likewise, state and local governments are facing projected tax revenue decreases of $167 billion in 2021 and $145 billion in 2022, with many relying on federal grants to offset those losses and lessen their financial strain.

Looking ahead to 2022, energy managers in manufacturing, government and other sectors have an opportunity to reduce costs and risks through innovative, long-term energy planning. Taking a more flexible approach to energy purchasing allows companies to think further into the future, buy energy at regular intervals and take advantage of market opportunities.

“Flexible strategies are designed to offer risk protection,” said Huston. “Using a flexible approach allows organizations to take advantage of the benefits of price declines like we saw in 2020 and mitigate any increases over time.”

“With these drivers in mind, Constellation is working with customers to create an energy strategy that includes price risk strategies and sustainability options.”

Protecting your business from future volatility

While a flexible approach to energy purchasing can help protect against market volatility, there is no one-size-fits-all approach. Every company is unique and will benefit from a customized strategy suited to its needs.

Some organizations may benefit from looking at the most significant driver of their total gas price—the commodity component—to achieve price stability over time. They can purchase energy using either a straight-cost averaging or modified-cost averaging approach, in which they buy less when prices are high and more when prices are low.

Other energy managers may prefer proactively monitoring the forward power markets to make more informed purchase decisions. Still, others might be ready to capitalize on the continued momentum towards renewable energy options that support their short- and long-term environmental goals or commitments.

As we come out of a year where the energy price showed unprecedented volatility, all organizations can become more resilient by making smarter energy purchasing decisions.

“With these drivers in mind, Constellation is working with customers to create an energy strategy that includes price risk strategies and sustainability options,” said Huston. “We’ve got the knowledge and the innovative solutions to help energy planners solve their most pressing energy purchasing problems.”

To learn more about specialized energy for your business, visit your association’s site.